You must have heard this phrase, “Nothing in life comes easy.” This is very true when we talk about the CFA course. Let us start with understanding what is CFA and why is it a frequently used term in the finance industry. CFA stands for Chartered Financial Analyst and is one of the most respected and prestigious credentials one can earn in the finance domain. Getting through and acquiring the CFA credential can be hard, but the perks and benefits it comes with are truly worth working hard for. The CFA credential is globally recognized and gives you an edge over other candidates, which helps in securing high-paying jobs. With that being said, it also provides networking opportunities for faster career growth.

To acquire this highly valuable credential, one is required to complete all three levels of the CFA course and must also obtain relevant work experience. Only after completing the pre-requisites, one can have better job prospects at top investment firms.

Addressing today’s topic of discussion that is, does CFA have any scope in India? Let us understand why the CFAs are in so much demand in India and abroad?

The main reason why CFAs are in so much demand is that there are plenty of students who attempt CFA every year but are unable to complete it and reach the end goal. CFA course is one of the best certification courses available in the finance industry as it helps in building a very strong foundation and opens doors for multiple opportunities not just in India but globally as well with ample choices and benefits in hand. If you work hard with full dedication and a mindset to acquire this credential, then no one and nothing can stop you. The CFA designation is often viewed as the “Golden standard in investment management.”

With this let us now see who all can pursue the CFA course?

The CFA course can be pursued by all those who are interested to build a successful career in the field of finance. It can also be done by recently graduated freshers or those who are in their last year of graduation. Along with this, four years of relevant work experience will also be needed. All the documents must be kept ready along with the experience letter.

How long does it take to complete the CFA course?

It takes a minimum of two years to complete all three levels of CFA.

At this point, you may also be wondering how different is CA from CFA? Let us find out:

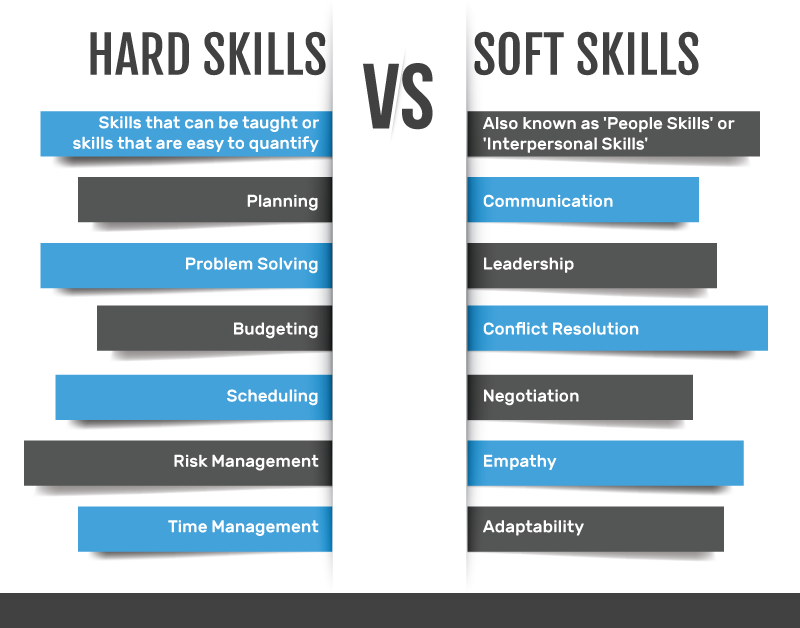

CA’s ideally deal with Accounting, Taxation, Law, Audit, Finance, whereas CFA’s focus on Investment, Wealth Management, Stock Market, Portfolio Management, Finance, etc. Another major difference we talked about earlier is that CFAs are globally recognized, whereas CA certification may not be valid in all countries. The most important thing to be considered is the passing rate before deciding on the career path. The pass rate for the CA examination is 0.5%, whereas for CFA it is 10% which is much higher compared to the CA certification.

The topics covered under the CFA course syllabus are:

1) Ethical and Professional Standards

2) Quantitative Methods

3) Economics

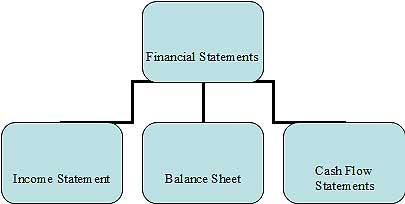

4) Financial Reporting and Analysis

5) Corporate Finance

6) Equity Investments

7) Fixed Income

8) Derivatives

9) Alternative Investments

10) Portfolio Management and Wealth Planning

Whereas under the CA qualification, the following topics are covered:

1) Fundamentals of Accounting

2) Cost Accounting

3) Mercantile Laws

4) General Economics

5) Auditing and Assurance

6) Cost Accounting and Financial Management

7) Direct Taxes

8) Management Accounting and Financial Analysis

9) Organization and Management

10) Fundamentals of Electronic Data Processing

Some of the common job profiles a CFA can acquire are Portfolio Manager, Consultant, Investment Analyst, Strategist, Wealth Manager, etc. Whereas for CA’s, it is mainly Internal Auditor, Management Accountant, Public Accountant or Government Accountant.

The CA certification gives you the flexibility to work in all industries. One of the major advantages of pursuing the CA course is that in the end they can also set up their practice and have their clients. They may not necessarily have to work on excel sheets, calculations, numbers, get into number crunching, and all. Most of the CA’s work as auditors to increase the company’s profitability.

The differentiating benefits of holding a CFA designation are as follows:

1) It helps in getting real-world exposure.

2) It also gives you an Ethical grounding.

3) Provides various networking opportunities and a global community.

4) It also helps in career recognition and standing out from the crowd.

5) High demand from employers.

This was all about the CFA course. Both these designations, CA and CFA are highly competitive and in demand. Candidates can build a successful career in both. A combination of both CA and CFA would give an immense boost to your career and would help you secure a higher position in comparison to others. If you are still confused or unsure which career path to take, CA or CFA, you can get in touch with our counsellors, who would be more than happy to assist you with your queries. All the best and happy learning.

Leave a Reply